This post was originally published in 2020, but the content has been updated for 2024.

Post COVID-19, businesses have seen a massive surge in credit card transactions for incoming and outgoing payments. While this made the payment process easier, it also meant a looming nightmare for finance teams at the end of every month – reconciling credit card expenses.

But where do business owners and finance teams start regarding business credit card management?

This blog discusses everything you need to know about credit card reconciliation, how it works, and why it’s crucial for businesses in 2023. We’ll also address some challenges accounting and finance teams face with reconciliation, after which we’ll give you the easiest way to solve your reconciliation woes. Let’s dive in!

What Is Credit Card Reconciliation?

Credit card reconciliation is the process by which accountants ensure that the transactions in a business’s credit card statement match its general ledger. For accurate and efficient financial reporting, companies need to know that these transactions took place and that the expenses on both sides are correct and valid.

If done manually, accountants sit and compare an organization’s credit card statement against its general ledger. If every payment on both sides matches, they can determine that the ledger was recorded correctly and can close books for the month.

However, if there are discrepancies, the responsibility of clarifying these values would fall on the financial controller. They need to find out who made the additional payments manually.

The reconciliation process typically occurs at the end of every month, while a more significant financial closing happens towards the end of each quarter or financial year.

What Are The Different Types Of Credit Card Reconciliation?

As mentioned earlier, a credit card transaction can impact two sections of your business finance: income and expenses. This means companies will have two types of reconciliations:

- Credit card statements

This would include all your business expenses – payments your organization makes for goods or services. For example, if your business is habitually issuing cards to its employees, they must be reconciled individually.

- Credit card merchant services

This would include all your incoming payments. Reconciling these transactions takes a little more effort than your outgoing payments, but there are defined ways to make this easier.

In this blog, we’ll only be looking in detail at the business expenses side; that is, transactions made by you or your employees to purchase goods or services for your organization.

Why Is The Credit Card Reconciliation Process Important?

Making a payment for your credit card statement without a second glance may not be the wisest thing to do. Big financial institutions make mistakes too, and it can end up costing you a lot more than what you should be paying.

The reconciliation process starts when a business receives statements for its expenses. The expense details are then manually matched with the company's internal finance records and checked for discrepancies.

This process ensures:

- The money leaving the account equals the amount spent in one fiscal period.

- No fraudulent activities or manual data entry mistakes get by.

- The company’s records always stay audit-ready.

How to Reconcile Corporate Credit Card Expenses?

Reconciliation, as we know, involves the process of matching expenses with your internal finance record. But how do you go about the entire process?

Step 1: Collecting and Sorting Receipts

Receipts are proof of expenses. It comes in several forms and helps account for money spent. For example, a purchase made using a credit card comes with an invoice given to the customer at the time of sale. These receipts should be collected from all the cardholders and stored for future reference.

Companies ideally use expense reports to collect and store employee receipts. This can be done manually using paper-based excel sheets and reports or by automation-driven tools like an expense management software.

Step 2: Matching Expenses to Transactions

Finance teams should match credit card statements to reported business expenses with the receipts. Businesses can do this with the help of any preferred system for reconciling.

Pro tip: Ensure that other than fees and interest charges, there shouldn't be any other unmarked items in the credit card statement.

Step 3: Notifying Your Bank In Case of Errors

There are always chances of error, either with or without intention. Thus, your finance teams need to be careful in identifying and notifying the bank authorities in cases of mistakes. In addition, ensure timely action by reporting any unauthorized activities or fraudulent behavior.

Some examples of commonly occurring errors with business credit card reconciliations are:

- Refund for a canceled purchase

- Charged for a failed transaction

- Bill payment processed twice, leading to duplicate charges

3 Challenges Finance Teams Face With The Corporate Credit Card Reconciliation Process

Most companies reconcile credit card expenses with paper-based and spreadsheet-driven methods. Unfortunately, this process is inefficient and forces employees to work long hours of manual labor. This also results in more inefficiencies and loopholes in the process. Given below are some challenges that can hinder your finance team's progress:

Ensuring Accuracy and Efficiency In The Entire reconciliation Process

For employees, reconciling corporate credit card expenses means entering data without making an error. Even a single missing number or double entry can put the employee's reimbursement on hold. Also, routinely submitting expense reports to get back their own money can affect employee happiness.

For finance teams, inaccuracy and inefficiencies in the credit card reconciliation process make the company vulnerable to financial exposure. Also, the traditional reconciliation methods include a high involvement of employees but do little to remove human-prone errors.

Curbing an Increase In The Volume Of Transactions

Corporate credit cards have helped revolutionize the speed and efficiency of business payments. But this also implies a high volume of transactions. Moreover, the ever-growing number of transactions increases the chances of missing human errors, duplicate submissions, and inaccurate information.

Your accounting team has to sieve through all the transactions and reconcile one-to-one and one-to-many transactions. This can prove to be a costly and cumbersome expense for your company and employees.

Recognizing and Correcting Policy Violations

According to a survey by Ernst & Young, financial departments spent up to 59% of their resources on managing transaction-intensive processes. Of this, 95% of the effort goes into already matching transactions rather than ones with entry-related problems.

The traditional approach to credit card reconciliation offers no quick and coherent method to find policy violations. Instead, employees must painstakingly go through every transaction to ensure expenses follow the company's travel and expense policies. This further adds to the delay.

Financial Leaks Because There’s No Way of Flagging Personal Expenses

Whenever an employee uses the company's credit card for personal expenses or overspends, there is no way of getting notified unless checked manually. Additionally, a loose policy framework coupled with weak enforcement of T&E policies can misinform employees and cause unauthorized purchases. This also increases the chances of fraud and claims of multiple duplicate expenses.

For employees who use the card for personal expenses, there must be a way to flag violations accurately. For example, when matching the expenses with the bank statements, the finance team has to identify and address personal expenses. While reconciling, finance teams also have to make sure that no errors by vendors or credit card issuers get by.

How Fyle’s Real-Time Credit Card Feeds Solve Your Reconciliation Challenges Permanently

Do your accountants still rely on broken bank feeds and delayed statement uploads for credit card reconciliations?

Just imagine how much easier their lives would be if these transactions were recorded and matched in real time. Well, Fyle’s real-time credit card feeds let you do exactly that.

By connecting directly to credit card networks like Mastercard, Visa, and American Express real-time credit card feeds bring credit card transaction data directly to your expense management system as soon as a card is swiped. This means accountants don't have to wait for bank statements to arrive or chase employees for receipts.

Since the transaction data is available instantly, accountants can track credit card spend, reconcile card expenses, track budgets, and identify unauthorized spend in real-time.

But this is just the beginning; here’s what else you can do with Fyle’s real-time feeds:

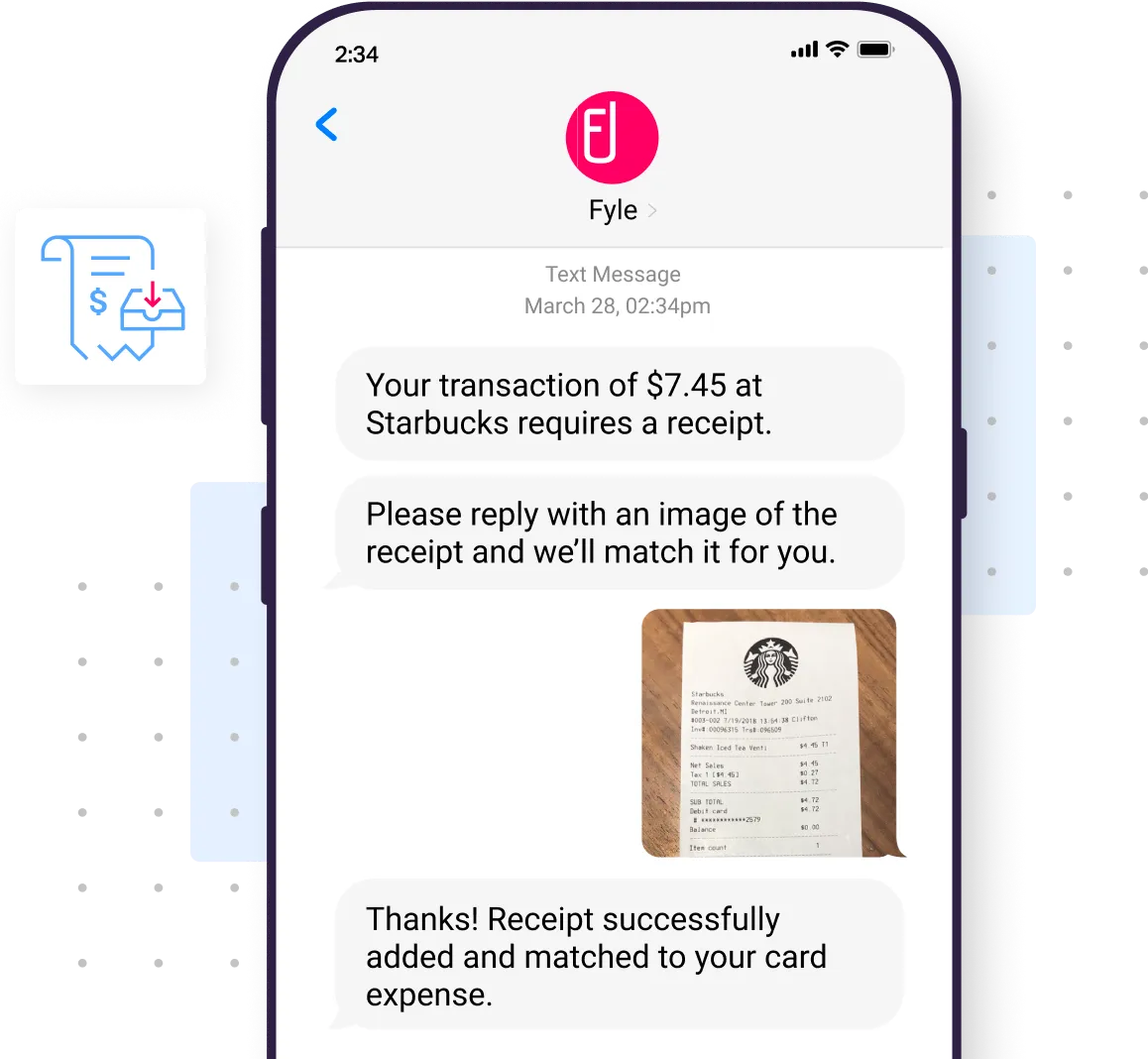

Receipt Collection via SMS and Other Everyday Apps

Fyle's integration with credit card networks like Visa and Mastercard allows employees to receive instant SMS notifications of all their credit card transactions. This helps them submit receipts for reimbursement quickly and easily, ensuring accurate and timely expense report submissions.

SMS receipt collection allows accountants to collect receipts instantly, which has reduced the time our customers spend on receipt collection by 48%. This simplifies the process by eliminating the need for employees to scan and upload receipts, reduces back-and-forth communication between accountants and employees, and eliminates the need to send reminders.

Automated Credit Card Reconciliation

Depending on your card program, accountants need to wait until the bank makes card data available to manually match transactions.

But now, Fyle's real-time credit card feeds automatically reconcile transaction data with receipt data as soon as the receipt is uploaded by the user. The credit card reconciliation process, which takes days to finish, can now be completed in less than 2 minutes with Fyle. All this without changing your existing credit cards!

Also Read:

- Why Should You Choose Real-time Feeds Over Direct Bank Feeds

- Why Real-time Credit Card Feeds are Better than Statement Uploads

- What Data Do You Get From Real-time Feeds, And How Do Businesses Benefit From It

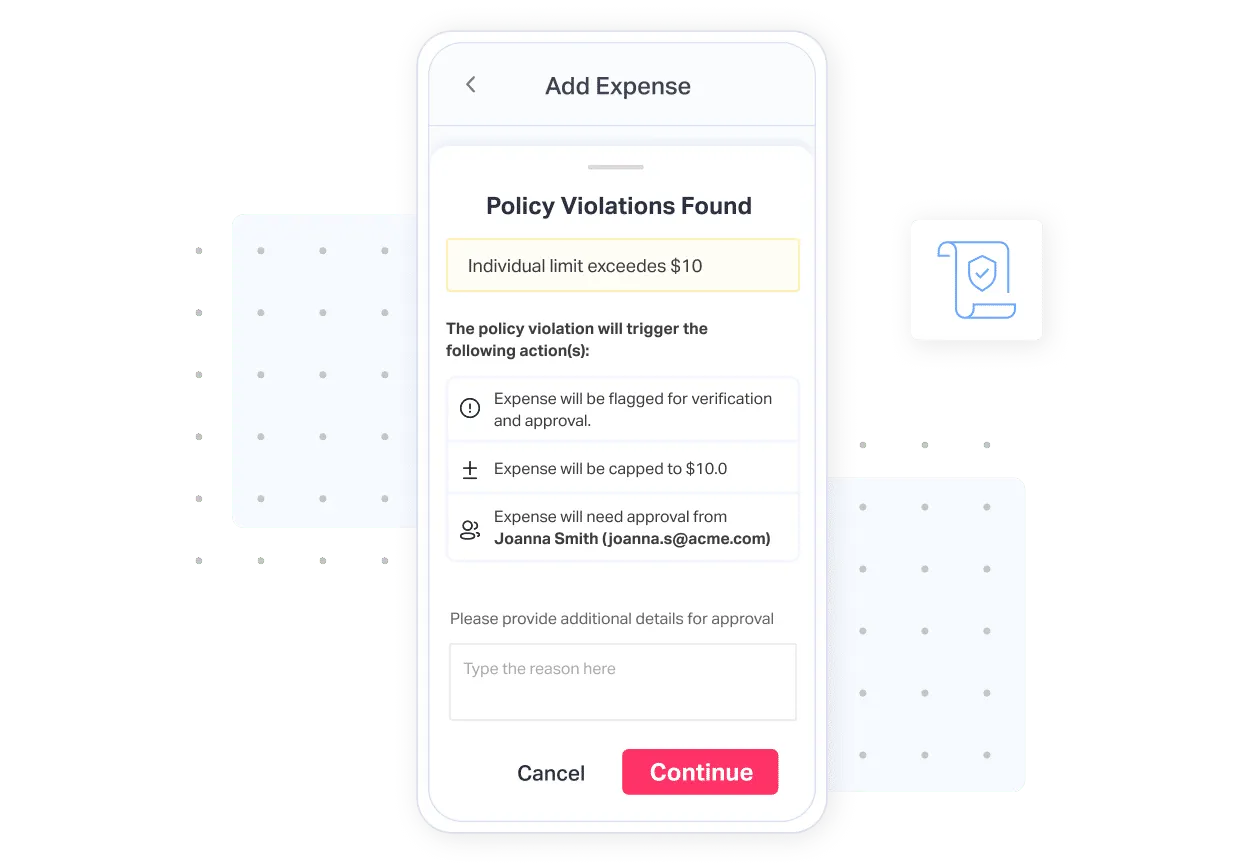

Increase Employee Compliance With Real-Time Policy Checks

Fyle automatically checks expense reports for policy violations as employees create them. Depending on the organization's settings, the following may happen:

- The expense report will not be submitted.

- An automatic cap will be placed on the expense.

- The expense report will be sent for additional approval.

Fyle's duplicate detection and implicit merge feature automatically checks for duplicate expenses. If two submitted expenses are found to be the same, the user is instantly notified and given the option to merge the two expenses. This helps to ensure that expenses are not duplicated, which can help to prevent fraud and improve compliance.

In Conclusion

In today’s world, information is at your fingertips. But when it comes to your business credit card transactions, you’re stuck in the dark. You have to wait days or even weeks to get visibility into where your employees are spending money.

That’s where Fyle comes in. We let you see it all in real-time, from anywhere in the world and it’s changing the way businesses manage and reconcile their credit card expenses. With Fyle, you get real-time insights into your credit card spend so you can make informed decisions about your finances.

Want to see how Fyle can help you? Schedule a demo today!